To minimize tax drag and optimize asset location for your investments, consider funding your accounts in the following order: Employer-Sponsored Retirement Accounts (e.g., 401(k), 403(b)) Reason: Contributions are often pre-tax, reducing your taxable income. Employer…

Read More

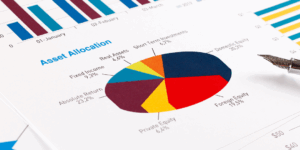

How I Manage Family Finances – 2025 Update

Here I go again with money moves I’ll make in our family finances for 2025, as this has become an annual topic. Many times, clients will ask how I invest money for my family. That’s…

Read More

Triple Tax Savings with HSAs: The Ultimate Guide for High-Income Earners

Health Savings Accounts (HSAs) are incredible, especially for high-income earners, because they offer a triple tax advantage, making them a powerhouse for tax deferral, medical expenses, and retirement planning. Here’s why: 1. Triple Tax Advantage…

Read More

Retire Smarter: Strategies for High-Income Earners to Maximize Your Tax Savings

There are many great ways for a high-income earner to save for retirement, some strategies that I even use in my family’s financial planning. One thing I have in mind for today pertains to singles/couples…

Read More