By Chris Heisten, CRPC®, CFP®, CSRIC®

In today’s world, we have access to an overwhelming amount of information about anything we want to buy. From product specifications to reviews and history, we can gather all the details we need to make an informed decision before making a major purchase.

But when it comes to creating a financial plan, the stakes are even higher. It’s a significant investment that can greatly impact your future financial well-being. That’s why it’s crucial to understand what you’re getting before committing to anything.

At Heisten Financial, we understand the importance of customizing financial plans to each client’s unique needs, and we believe that transparency is key to building trust and empowering our clients to make informed decisions about their financial future. That’s why we created a sample to give you an idea of what your potential financial plan could look like. Read on to see how we can help you create a plan that fits your goals and aspirations.

What Does a Financial Plan Include?

First, you may be wondering about what goes into a comprehensive plan. Financial plans often address a myriad of concerns and goals, from tax planning to retirement income strategy. Depending on your needs, your plan may narrow in on one element or address multiple goals you’d like to pursue over time. Whatever you choose to focus on, your financial plan is designed to serve as your road map, helping you pull all the moving parts of your finances together so you can navigate the years before, during, and after your transition to retirement.

We believe a good financial plan should give you a detailed, complete view of your current financial situation. It should address all the pieces of your financial puzzle, from stresses and fears to your values and dreams, and include risk factors, cash flow, retirement, estate planning, taxes, education, and income strategies to help bring you clarity and guidance. It is through our planning process that we help you prepare for life’s expected and unexpected circumstances.

The result is a simple yet powerful road map to guide you toward financial freedom.

See a Sample Financial Plan

We’ve developed a sample financial plan that reflects our planning process. It looks at a fictional couple, Matt and Mary Jensen, currently 52 and 50, who are planning to retire in 2035 and 2037, respectively. Our goal is to solidify the chances of the success of a financial plan. Let’s dig into the Jensen’s plan to see where they are currently and how we can help them.

Likelihood of Success: The Monte Carlo Simulation

There are plenty of data points to analyze and build the plan around. But one of the first stops in our planning journey is analyzing how well the Jensens are set up for success based on what they’re currently doing. That will help direct our focus of where and how to improve their financial plan. To do this, we use Monte Carlo Simulations, a simulation that runs 1,000 trials of all the variables to predict potential outcomes.

As we can see below, Matt and Mary have only a 30% probability of success with their current financial plan. That doesn’t provide much hope for their financial future. But our plan addresses the concerns with their current plan to get them to an 81% probability of success.

Retirement Analysis Action Items

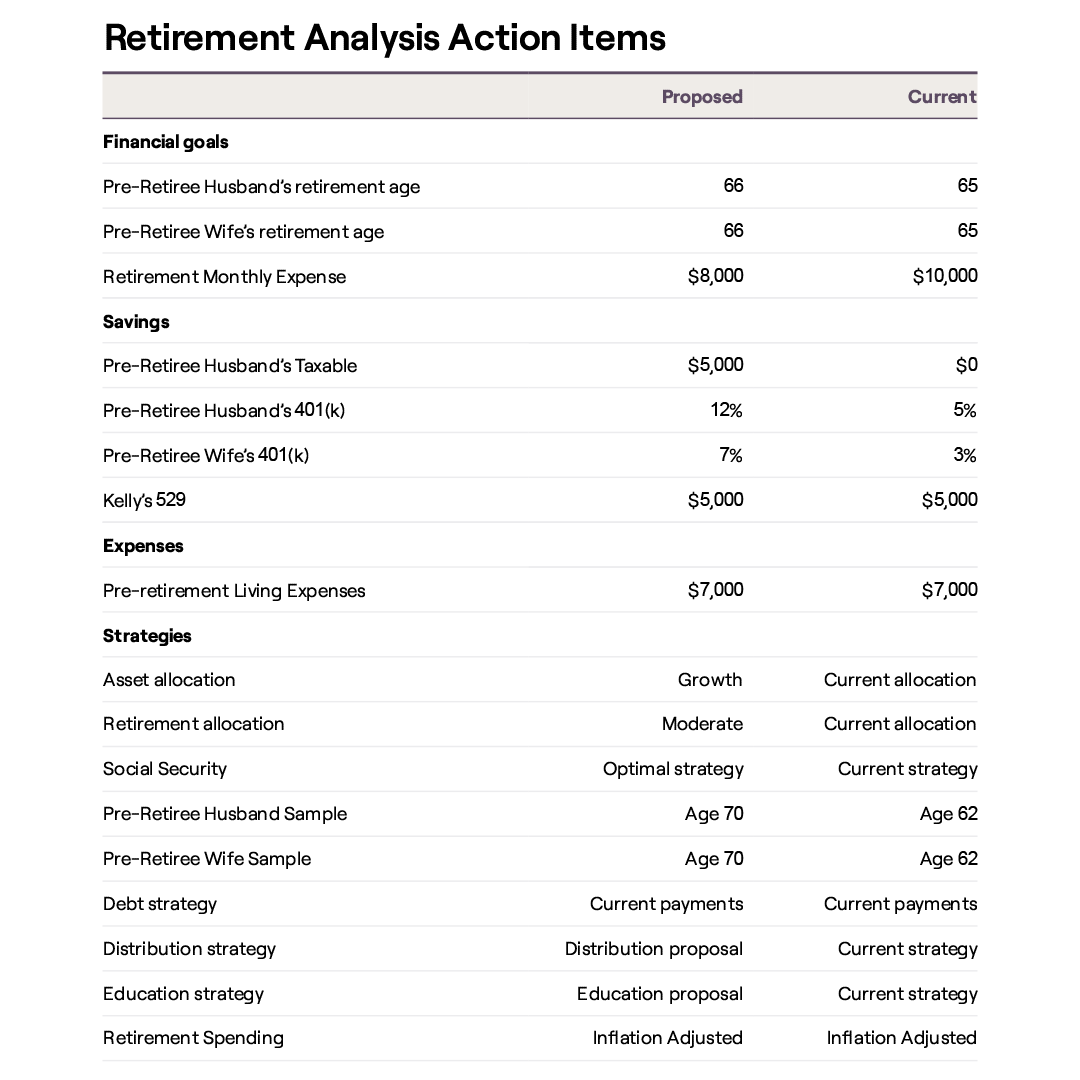

While the probability of success sounds great in theory, what are the components of the proposed financial plan that will get the Jensens to this higher probability of success? For that, we turn to the retirement analysis action items page of their financial plan. This page delves in how the two plans compare head-to-head and where the adjustments need to be made to increase the chances of success.

As you can see, some of the key changes come with how, and how much, the Jensens are saving. In addition to pushing retirement out a year to 66 for both Matt and Mary, we’re pushing more of their savings into their investment vehicles, both in Matt’s taxable and in both of their 401(k)s. We’ve also dropped their monthly expenses in retirement to more closely mirror what they currently spend per month.

Savings Analysis

With those now accomplished, we can turn to the savings piece of the puzzle of this proposed plan.

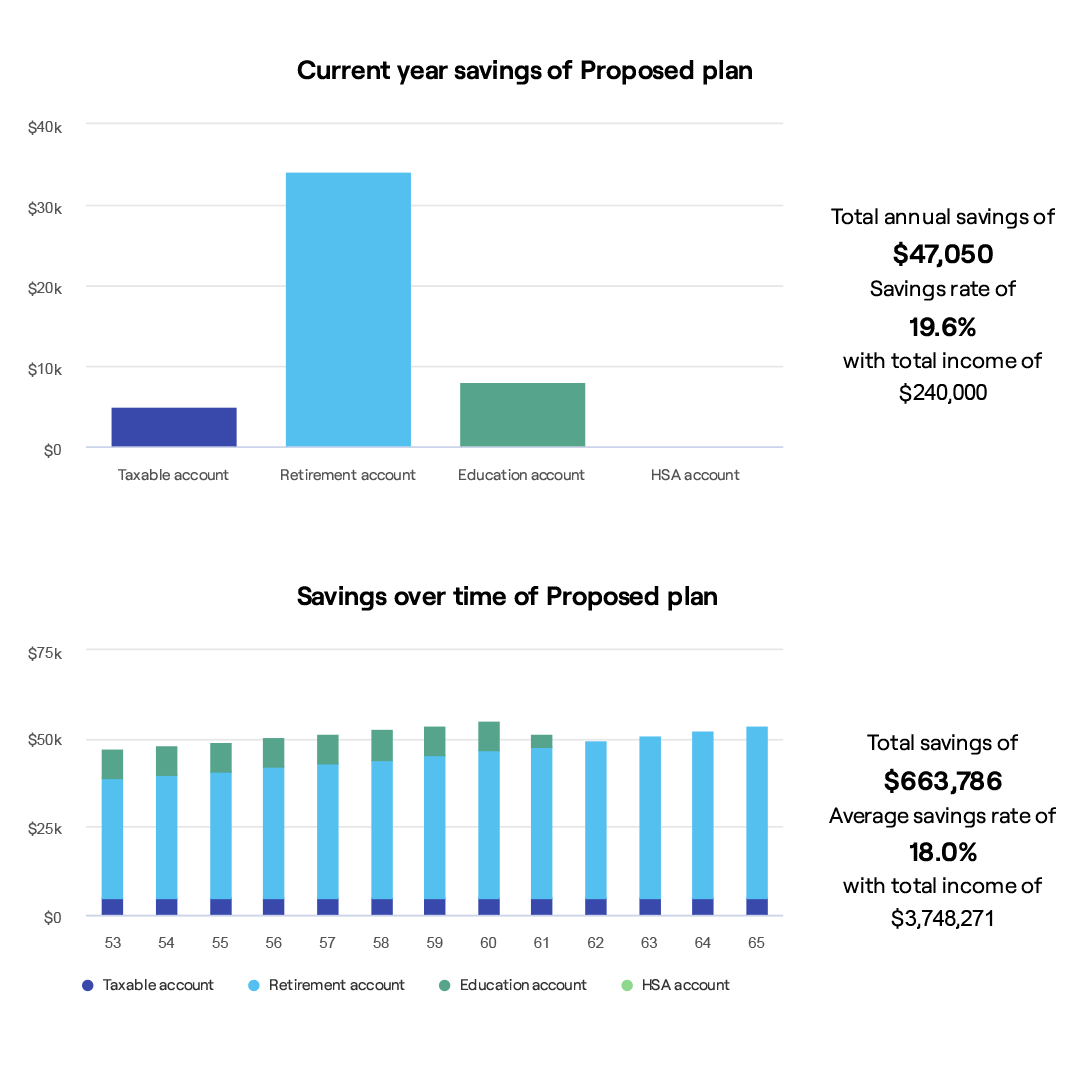

Now that the Jensens have altered their retirement savings, what will that look like in numbers? Together, the Jensens make $240,000 a year, and our proposed plan says that 19.6% of that income in the current year will go toward retirement savings. Those annual savings will fluctuate as we can see in the bottom figure, but over the course of their remaining pre-retirement years, that annual savings is projected to build to more than $660,000.

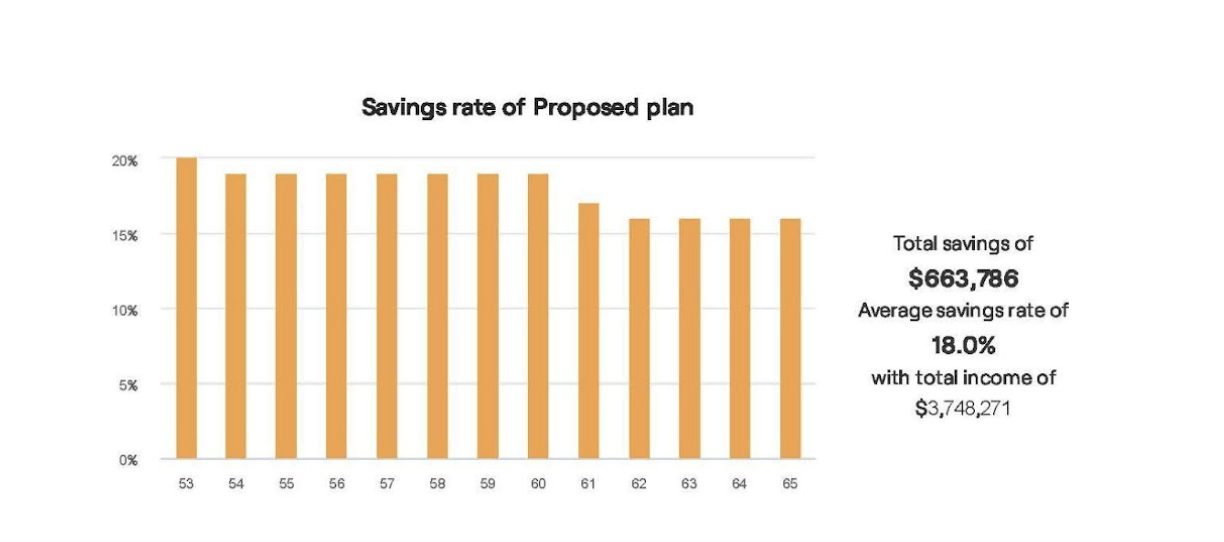

As part of the savings analysis, our reporting tool also provides a breakdown of the savings rate by year over the course of the pre-retirement years. Along with that, there’s an easily identifiable savings rate average for the plan.

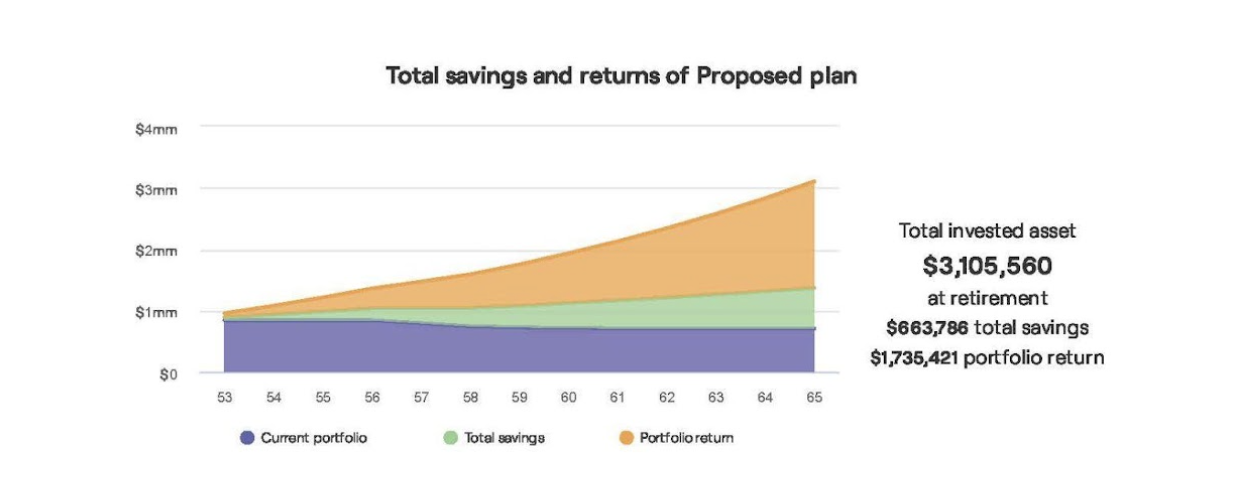

The Jensen’s $3.1 million at retirement is a large number, and only one chunk of that is their total savings of $663,786. So what else factors into the $3.1 million? We can turn to this chart in their plan. You’ll see part is their current portfolio, while the rest is the portfolio return.

The previous charts all encompass the inflows into the Jensens’ financial plan, but what about the outflows? After all, one of the most important parts of the financial plan is building confidence about what your life will look like in retirement — and that revolves around retirement income.

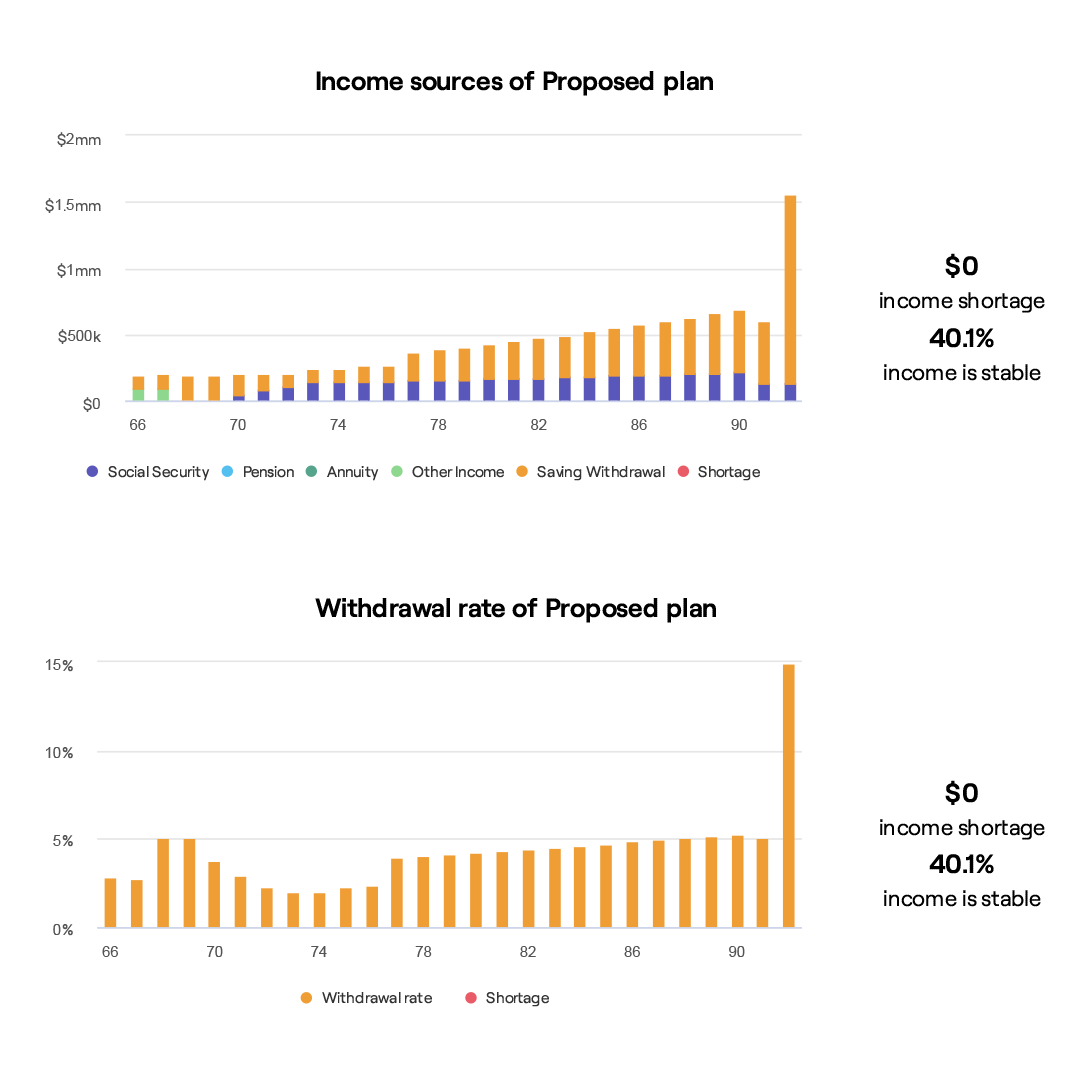

The following two charts capture where the Jensens’ retirement income is sourced from over time, and the rate at which they’re withdrawing from their accounts.

There are a lot of facets to a financial plan like the Jensens’ plan and plenty of other pieces to the report. So while we won’t dig into all the nitty gritty details of their plan and the report, what we’ve discussed helps paint the picture of some of the main pieces of a financial plan.

Keep in mind that this is only a hypothetical plan presented to illustrate what a financial plan may resemble should you sign on to work with us. The characters and circumstances are completely fictional and are for illustrative purposes only. Be sure to seek the advice of a qualified professional for your particular situation and not rely upon any of the information herein to make personal financial decisions.

Ready to Take the Next Step?

Working with a financial planner can be one of the best decisions you make for your financial future, but who you choose to work with is a decision not to be made lightly. Take a look through the full sample plan here to see how our process helps you pursue your goals and find financial freedom. Once you’ve reviewed it, give us a call and we can discuss further how we can create a tailored financial plan for you.

At Heisten Financial, we don’t predict—we help you plan with confidence. Partner with us to establish a customized financial strategy by emailing jami@heistenfinancial.com or calling 907.222.6270, or schedule a complimentary assessment today!

About Chris

Chris Heisten is the President and Founder of Heisten Financial LLC, a fee-based boutique financial planning firm focused on giving clients back their time so they can spend it doing what’s most important to them. Acting as a true fiduciary for his clients, Chris aims to solve their financial pain points and move them toward financial freedom. In the financial industry since 2007, Chris partners with business owners and oil workers on their journey through life, striving to instill calmness and a sense of direction as he simplifies the complex. He loves nothing more than seeing clients experience relief when they achieve what they thought was impossible.

Chris graduated from the University of Maine, where he played hockey on a scholarship, and retired from professional hockey in 2007. In the community, he remains engaged serving as a youth hockey coach. Chris holds the CERTIFIED FINANCIAL PLANNER™, Chartered Retirement Planning Counselor℠, and Chartered SRI Counselor™ designations. Outside of the office, he enjoys trying new food and wine, reading, traveling, playing golf and hockey, fat tire biking, and donating to local charities. His passions include being a husband and dad, lake life with the family, watching his son and daughter play sports, and spending time with his wife. To learn more about Chris, connect with him on LinkedIn.